Not the central banks, the commercial banks that we all use: it has been discussed among insiders because of a controversial article by two economists

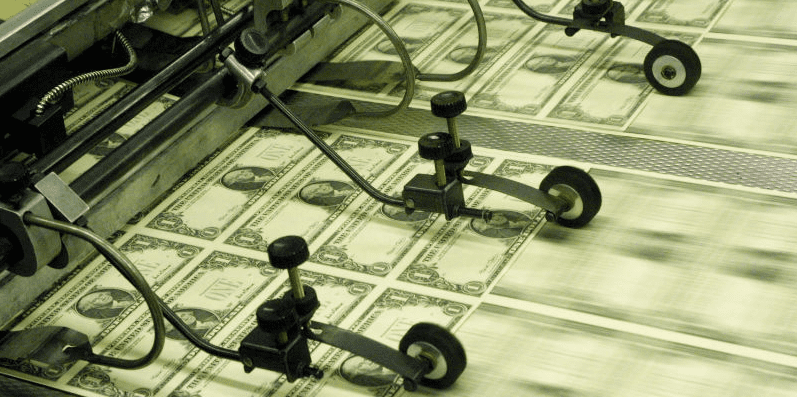

A strange debate has involved economists, scholars and even a former Vice-President of the European Central Bank. The debate was born from an article published on the Vox.eu website, one of the most important websites where European policy is discussed, to which in short many have responded. The subject of the debate sounds quite bizarre, but it is a very serious matter: do banks create money out of nothing?

We are not talking about central banks, which, as we all know, create money (albeit in a slightly more complicated way than you might think), but about commercial banks, the private banks where everyone deposits their salary and from which they withdraw with their ATMs. That these banks create money and, indeed, that most of the money in circulation is created by them, is not in question: when a bank receives 100 euros on deposit and then lends 90 of those euros to another customer, it has in fact “created” 90 euros. Before there were 100 euros in circulation, now there are 190: the hundred of the deposit, which the client can withdraw at any time, plus the 90 lent to the second client (there are then other discussions on how this creation takes place).

But the authors of the article that started the debate, Pontus Rendahl, and Lukas B. Freund, two scholars of economics at the University of Cambridge, argue that it is wrong to think that this creation happens “out of thin air”, i.e. from nothing. They also claim that this belief is widespread and cite articles published in scientific journals, international newspapers, but also seem to blame some official publications made by central banks.

According to the two economists, claiming that banks create money “out of thin air” ends up introducing a dangerous metaphor, that of the “magic money tree” that produces money at will. The reality, they say, is very different: banks don’t create money from nothing but thanks to their “assets”, that is thanks to what they own, their reliability spread among customers, the goods they own and the liquid money they have in their safes.

To explain what they mean, the two economists give the example of a Cambridge student named Lukas (which is also the name of one of the two authors of the article) who tries to pay for a beer in the city with a bill of exchange, a promise of payment. The pub will hardly sell him the beer: the managers don’t know Lukas and don’t know if they can trust him to pay back the bill of exchange. But Lukas is lucky, and his supervisor Pontus (which is the name of the other author of the article) decides to change Lukas’ IOU with his bill of exchange. Pontus is much better known and respected in the city, so Lukas finally manages to get his beer. Not only: Pontus is so well known that the pub uses the bill of exchange to pay the brewery from which he gets his beer.

In a way, Pontus has created money: Lukas didn’t have money to buy a beer before, but he got it thanks to his intervention and that “money” was then used by the pub to pay a third party, the brewery. According to the two authors, this example shows that the creation of money did not happen “out of nothing”: Pontus has a series of “assets” that allowed him to create money. The trust of the community, his ability to assess whether Lukas will return the money to him and finally a cash account that he can use in case the pub should demand his payment before Lukas finishes repaying his debt.

With the banks, the authors conclude, it works the same way. Their ability to create money by making loans derives essentially from the fact that they own assets: assets that guarantee that they will be able to repay their debts (for example our current accounts). If customers started to suspect the quality of a bank’s assets (as the pub might suspect Pontus’ economic soundness), nobody would deposit money in its accounts and the bank would soon get into trouble.

This article has provoked a lot of reactions mainly because of the implications that the authors do not express directly. In particular, since the article stresses the limits of money creation, many of those who argue that these limits do not exist, or that they are weaker than is usually thought. For example, it has provoked many responses among the supporters of the MMT, an unorthodox economic theory according to which as long as productive factors are not fully exploited (i.e. as long as there are unemployed and unused resources) you can, and must, print all the money you want.

But the article also attracted the comments of characters much more inserted in the main current of current thinking econ

But the article also attracted the comments of personalities who are much more in the mainstream of current economic thinking, for example, Vitor Constâncio, former vice president of the European Central Bank. In a very commented Twitter thread, Constâncio called the article by the two economists “strange”. Although she does not consider their points necessarily wrong, Constâncio wonders what motivated them and whether they are useful to the debate. For him, the problem is that the two economists seem to take for granted that the expression “banks create money from nothing” means that they can do so without limits. The limits exist, however, and they are first and foremost the limits imposed by the financial regulations implemented by the various central banks and public authorities.

Having established that banks cannot create money at will, the fact remains that banks actually create it from nothing or almost nothing. Constâncio recalls that if in the classic example (the 100 euro deposit used by the bank to make a 90 euro loan that we saw above) the deposit precedes the loan, the reality is very different. No bank today waits for the money of a deposit before making a loan. In fact, if necessary, they can resort to many other ways of financing themselves: by asking the central bank for loans, by exploiting the interbank loan market, by issuing their own financial instruments such as bonds.

In the modern financial industry, in short, there is no need for someone somewhere to physically save money and then pour it into his account to allow the bank to make loans, and thus create money. What represents the real constraint to the production of money are the regulations, for example, those that establish how many reserves the bank is obliged to maintain the loans it grants. But it is possible, and it happens frequently, that a bank exposes itself a lot by lending a lot of money and, later on, supervisors ask its managers to increase its reserves, for example by collecting new deposits or using other instruments.

According to Constâncio, it is important to remember this sequence (i.e. that money creation can come before deposits) because it is one of the reasons why regulations and supervision of banks are so important. Even if it is not said openly by the two authors of the article on Vox.eu what their explanation risks to suggest is that the limits to the creation of money by banks are limits imposed automatically by market forces: by the assets that the bank owns and therefore by the trust that customers and competitors have in its ability to return deposits. In short, the risk is to suggest that no other rules are needed since the system would be able to do it alone. “I hope that the article in question”, Constâncio concludes, “will not be interpreted as an attempt to call into question the most widely held views on money creation. But, if such a risk exists, there are these tweets”.

Leave a Reply