It will allow the deduction of up to 90% for renovation work paid in 2020 (and therefore also started in 2019).

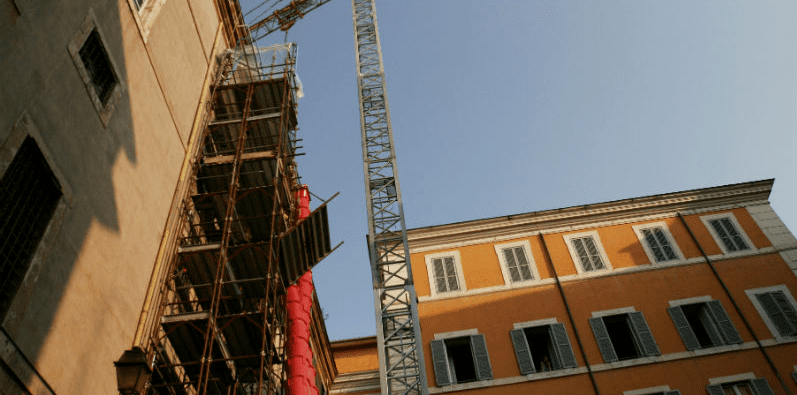

From next year, the so-called “facade bonus” will come into force, which will allow savings of up to 90% on ordinary building facade renovation work. The bonus will make it possible to deduct from taxes up to 90 percent of the cost of work carried out on the facades of buildings in zones A and B (i.e. old town centers and urbanized areas). The deduction can also be used for work carried out before 2020 but provided that it is paid in 2019. The bonus is contained in the budget law which will be finally approved in the coming weeks.

Il Sole 24 Ore has listed all the conditions necessary to obtain the bonus. The incentive will cover work on the facade and the so-called “opaque parts”, i.e. balconies and friezes; painting, plastering and facade cleaning will be covered. On the other hand, interventions on fixtures and cables running along the facade will not be covered. If the intervention concerns more than 10% of the external surface of the building, the insulation requirements must be respected. Otherwise, in order to receive the bonus, you will have to intervene to improve the insulation, possibly redoing the coat of the building, an operation that can enjoy the eco bonus between 65 and 70 percent.

The standard, strongly supported by the builders’ association ANCE, could bring up to EUR 2.8 billion of new work in 2020, according to estimates made by ANCE itself. Those who will not be able to take advantage of these deductions will still be entitled to the other deductions currently in force: almost all renovation work in fact (including, for example, the installation of new tents) has a tax deduction of 50%.

Leave a Reply